What You Need to Know about Taxes

If you’re overwhelmed thinking about taxes this year, you’re not alone. Taxes get more complicated every year, and it can be paralyzing to try and take on so much detailed paperwork, not to mention looking for deductions! Consider hiring a professional to handle your taxes this year. Not only does it make it easier for your workload, but they also specialize in making sure it’s done accurately, and you get deductions you would have missed on your own.

To at least understand the basics of tax variables and speak the language, we’ve rounded up what you need to know when it comes to business entity implications, liability exposures, common deductions, management tools, and things to keep in mind if selling your agency.

Your agency’s tax implications

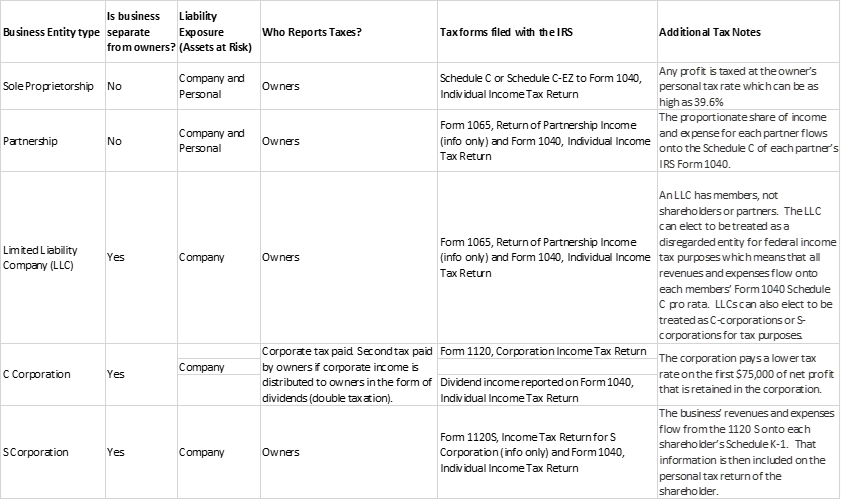

Each entity type has its own tax implications and liability exposures.

As you setup your business entity and even as you grow over the years, be mindful of how your business entity is structured as it may also have impacts on your perpetuation plan.

Common Tax Deductions

We’ve nailed down who is responsible for reporting and what forms you need, now let’s make sure you are maximizing your deductions!

- Car Allowance- Gas, oil, repairs - oh my! These are all deductible and the standard mileage rate is now 56 cents per mile. You can claim any mileage outside of a normal commute.

- Continuing Education- Keeping up with licenses and certifications can be costly, but these two are deductible.

- Insurance- Even insurance agents can deduct insurance (health, business, vehicle, etc.). If you work from home, you can even deduct part of your homeowner’s insurance (based on business occupied square footage), but keep in mind you can only deduct insurance if it’s for your business.

- Work Travel- Need to take a trip or entertain clients? You can deduct related expenses like flights along with any baggage fees, taxis, hotels and of course meals and entertainment. Don’t get too carried away, though, because if the meal is too outrageously expensive, it won’t be considered a valid deduction.

- Office Space- Whether you are in a home office or regular office, you can deduct things like utilities and repairs. If in a home office, be sure to deduct percentage relative to space occupied in the home for the business.

- Office Supplies and Equipment- All the way down to the paper clips, you are able to deduct office supplies and equipment that are used for the business.

- Advertising- Ads (yes, even Facebook ones) to business cards are deductible.

- Charitable Contributions- An agency should always be involved in their local community and part of that is supporting charities. These are valid deductions you can claim on your taxes.

Tools to manage expenses

The last thing you want to do as a business owner is to spend a lot of time trying to track down documentation. It seems like a lot to keep up with, but there are several tools that can help you manage your deductions and make filing a little less daunting.

Bookkeeping:

- Quickbooks - the most commonly used accounting software for tracking invoices and payments.

- Wave – free and similar to Quickbooks, they have the same basic functions for small businesses.

To manage receipts:

- ShoeBoxed - simply snap a picture of your receipt and it get’s digitally copied into the app. The app then sorts, categorizes, and archives all images.

- Expensify - Free! Same as others, you can simply snap pictures of your receipts and enable the app to upload your info for record keeping.

- Hrdlr - tracks mileage and expenses. You can download a report for your CPA when needed.

Track mileage:

- MileIQ - use this app to automatically track travel and log reports that can be used for either tax deductions or submitted for reimbursement.

- Triplog- great for tracking mileage. Their professional plan gives you IRS compliant reports and daily backup to the cloud with ability to take photos of receipts.

Impacts on selling your agency

Not only will your taxes be varied by your agency’s entity type, you’ll want to know how your entity type may affect the sale of your agency in the future.

When going to sell any business, make sure you P&Ls are in order. Buyers will be looking for those as part of the valuation process. There are several tools available to help you manage your revenue and expenses to give accurate profit calculations. Note that most buyers are looking for asset purchase so they can amortize the book of business over 15 years.

Sole Proprietors and Partnerships:

Only the assets (book of business) can be sold and will be taxed as capital gains between 15-20% depending on modified adjusted gross income.

Limited Liability Company (LLC):

Since LLC’s have members instead of shareholders, capital gains taxed would be passed onto the members in the event of a sell.

C-Corp:

Shareholders can sell the stock of the C-Corp resulting in capital gains tax to shareholders. If selling the assets of the C-Corp it can result in double taxation.

S-Corp:

With a S-Corp, selling the assets results in capital gains treatment for the shareholders, but without double taxation like a C-Corp.

It’s possible to change the type of your entity if you know you’re planning to sell and want to take taxes into account. However, since tax laws can change over time you’ll want to do a lot of research and make sure you’re making the right decision for your agency. Changing for the sake of changing can be a lot of paperwork with little return on investment.

While this is a large overview of things to keep in mind during tax season, we hope you’ll find them useful as you continue to build the wealth of your agency. As an agency owner, make sure you know the short game and the long game plan for your agency. Take advantage of all deductions possible to help your agency continue investing in its future, and reap the benefits along the way.

2021 tax extensions: Sole Proprietors and single owner LLCs- 2021, extension to May 17th. Partnerships and S Corps- deadline of March 15th, and C Corp deadline of April 15th.